Environmental or social characteristics securing contribution to an environmental or social objective

Sustainability and ESG policies are an integral part of our business model

ESGESG Reports

Halcyon is committed to its basic principles of responsible investment

As an Article 8 Fund under SFDR, Halcyon promotes

Compliance with the “do no significant harm” principle

Adherence to “good governance”

Halcyon’s ESG Methodology

To deliver our sustainable business model, we have developed a well-defined ESG value creation framework, across all stages of the investment process. From initial screening and due diligence to exit, we integrate ESG to support decision-making at each stage, where relevant and appropriate.

Initial screening

Due Diligence

Monitoring and engagement

Exit

- Consideration of financially material ESG factors alongside traditional factors in investment decisions

- Adherence to environmentally safe policies, alignment to good governance principle and non-violation of global standards

- Identification of measurable positive social and environmental outcomes alongside a market-rate financial return

- Implementation of proprietary ESG due diligence checklist processes

- Engagement of advisors and ESG experts to assist in conducting ESG due diligence

- Use of business intelligence tools for the assessment of ESG related risks and management standards

- Close collaboration with management teams to improve the ‘value fundamentals’

- Continuous monitoring of our portfolio companies’ ESG progress, through external assessments and non-financial reporting

- Provision of guidance to investees in evaluating and managing ESG issues

- Estimation of valuation premiums for business models and competencies that reflect ESG best practices

- Support our investees to integrate, measure, and communicate their bespoke approach to ESG, as these characteristics increasingly valued in investment exits

- Disclosure of ESG information, gathered through Halcyon Fund ownership period, to potential buyers at exit stage

Halcyon Philosophy & Actions

At Halcyon Equity Partners, we believe that success isn’t just measured by financial growth, but by the positive impact we make on the world around us. At the heart of our own philosophy is a simple principle: giving back is not an obligation, but a responsibility.

HALCYON KEY FOCUS AREAS

Education and Youth Empowerment

Sustainability and Environmental Stewardship

Community Engagement

Employee Volunteering

CSR Actions

2024.12.19

Halcyon Equity Partners Collaborates with Brown University’s Summer Internship Program

Halcyon Equity Partners AIFM has been approved to participate in Brown University’s Summer Internship Program

Read more2024.08.13

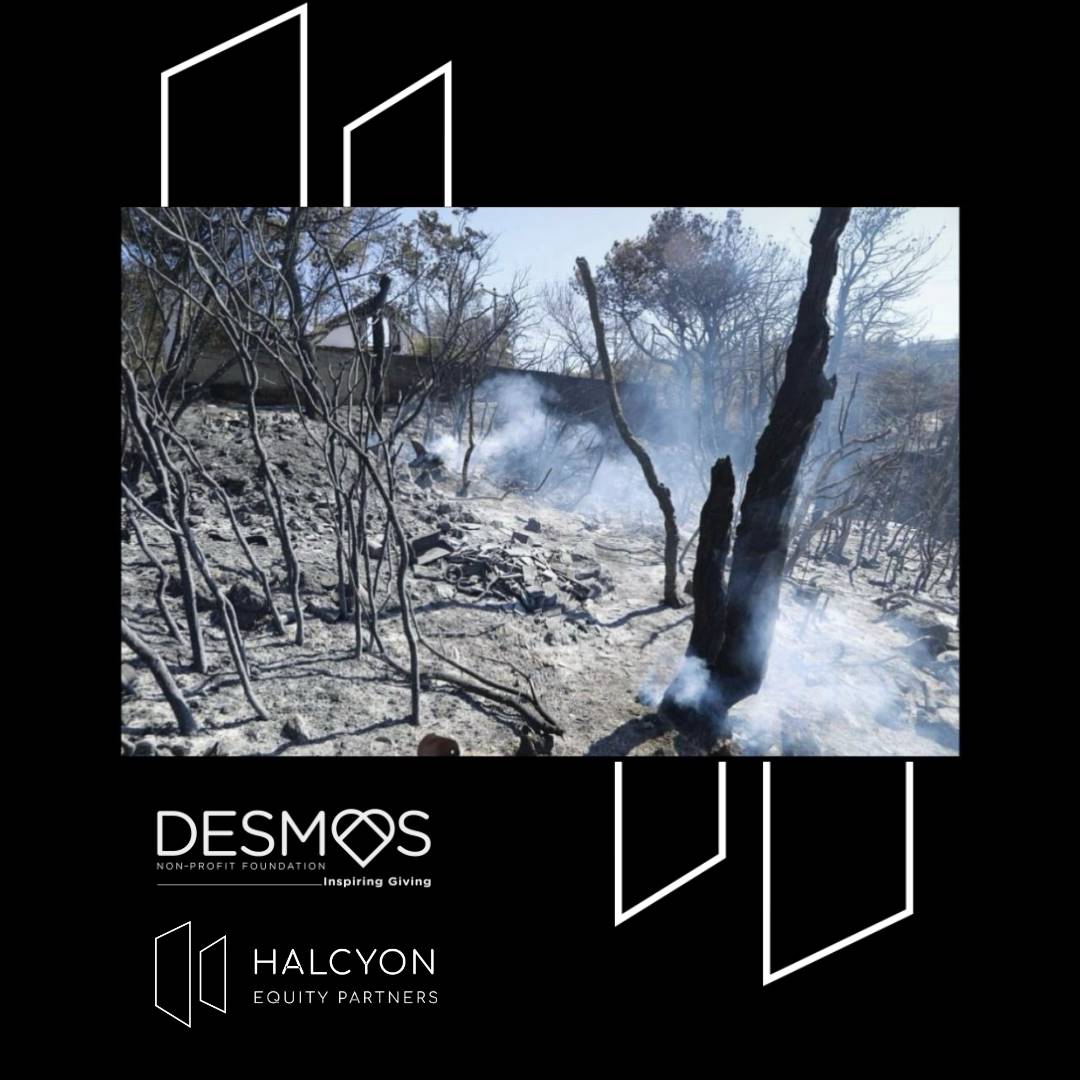

Halcyon Equity Partners Supports DESMOS Emergency Relief Fund: Immediate Response to the Attica Wildfires

Halcyon Equity Partners proudly supported the DESMOS Emergency Relief Fund in response to the devastating wildfires that impacted North-Eastern Attica

Read more2024.05.23

Ms. Eleni Bathianaki Selected as Mentor in the EIF Empowering Equity Mentorship Programme

Halcyon Equity Partners is pleased to announce that Ms. Eleni Bathianaki has been selected as a mentor for the Empowering Equity Mentorship Programme by the European Investment Fund (EIF)

Read more